Please Consult With Your Financial Advisor Before Taking Any Position Based On This Analysis

Sumitomo Chemical India manufactures, imports and markets products for crop protection, Grain fumigation, rodent control, biopesticides, Environment Health, Professional pest control, and feed additives for use in India.

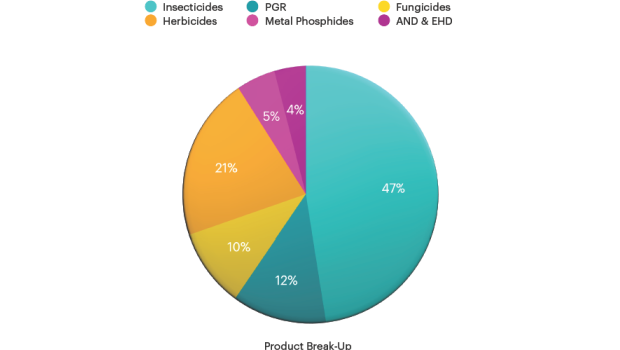

The company has a major part of its operations in Insecticides which constituted of 47% of its total revenues in H1-FY21. With the support of parent company Sumitomo Chemical (Japan) which was started in the 16th century, It’s poised to grow much quicker than other Indian agro chemical companies.

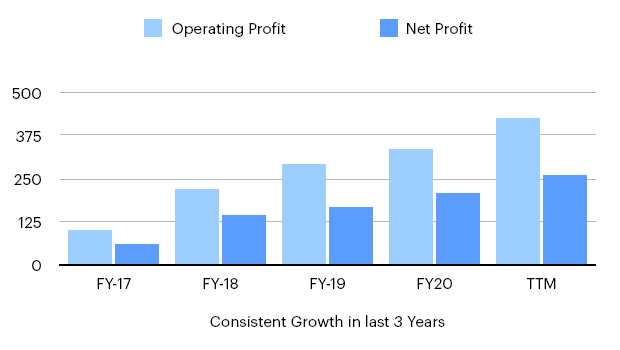

Financial performance

Sumitomo Chemical India is trading at a market capitalization of 14.6k Cr. And trading at a TTM P/E of 56. Return ratios are very well placed: RoE at 22.4% and RoCE at 29.3%. In H1-FY21, Company reported revenues of 1550 Cr. INR and EBITDA of 338 Cr. INR, Margins at 21.8%, PAT of 237 Cr. INR which translates into H1 EPS of 4.74 INR. The

company has launched 3 Insecticides and 1 PGR in H1-FY21.

In H1-FY21, SCIL did 87% of total revenues in domestic markets while 13% came from exports to Japan, Europe and North America etc. SCIL is a net debt-free company.

The company is improving its operational efficiency and cash flows have been solid in the last 3 financial years. In H1-FY21, SCIL reported Cash and Cash Equivalents of 466 Cr. INR and Investments of 203 Cr. INR in Liquid funds and other assets.

Only negative point is that debtor days are high (at 128 days) which is common in most the agrochem companies. It has reserves of 916 Cr. INR as on H1-FY21.

SCIL has successfully completed the merger of Excel Crop which will enable to achieve quicker growth in short span of time. The company has achieved 10 times growth in last 10 years with being a debt-free and cash rich company which is a big achievement for any company.

SCIL has 5 manufacturing facilities in India and 200+ Product registrations in India with more than 25 patents. Company has more than 13,000 distributors and 1,500+ employees.

SCIL will always get tech support from the parent company which will support it to grow much quicker than the existing players.

R&D Facility

SCIL has 3 fully equipped, DSIR approved R&D labs located at Mumbai, Bhavnagar and Gajod. R&D team comprises of 75+ qualified and dedicated engineers and scientists and they have granted 25+ patents across various geographies and 9 more applications filed.

Pipeline of 9 new combination products/ pre-mixtures currently under development out of which 5 insecticides, 2 fungicides, 2 PGR. There are 2 more technical products which are being developed (1 insecticide and 1 herbicide).

SCC Japan’s chemistries will always help the company to improve production processes and efficiencies.

Growth Triggers

- Continued Investment in R&D and Pipeline : Aims to invest in seamless integration of R&D between SCIL and SCC units, introduce new product as per market demand.

- Capacity Expansion : SCIL aims to invest ~15% of consolidated EBITDA every year for upgradation of manufacturing facilities and maintain highest safety standards with being operationally efficient.

- Further brand development through investments for marketing of new and existing products and brands.

- Expanding export business by enhancing exports in regions like Africa and Europe.

- Leverage SCC’s global supply chain and marketing network to drive exports.

Sector Tailwinds

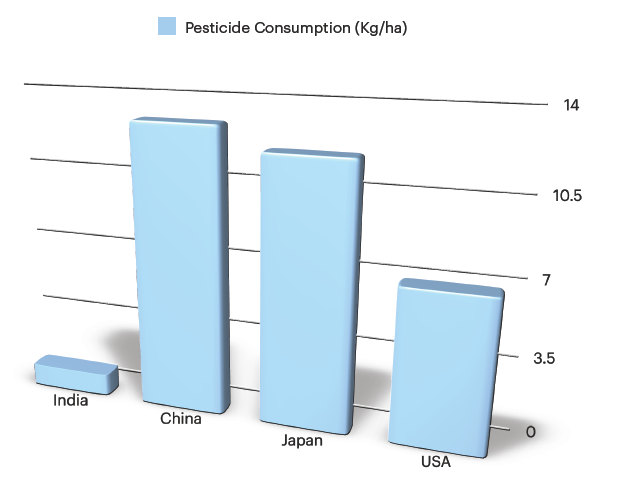

India is the highly underpenetrated market in pesticide consumption as compared to other developed nations.

There is a significant growth opportunity for Indian players with Policy initiatives and the introduction of new farm bills. With China’s competitiveness eroding, India has higher chances of growing in the agrochemical business.

With a rising population, increasing food demand, and increasing demand for horticulture and floriculture, the Agri and food processing industry is poised to grow and get investments in the future.

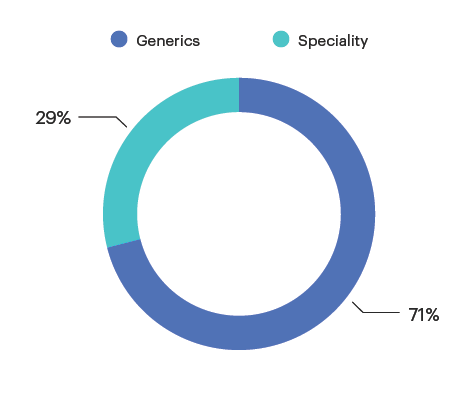

SCIL has following advantages as compared to the peers :

- Strong R&D Capabilities.

- Consistent Cash flows and improving operation efficiencies.

- Capacity expansion by internal accrual by being net debt-free.

Valuation and Outlook

We expect that the company will continue performing well in the future with the support of the parent group and their strategy of expanding the businesses. In H1-FY21, SCIL reported EPS of 4.74 INR and we are expecting it to deliver EPS of 6.5+ INR in FY-21.

As per our conservative expectations based on the track record of the company, We expect the company to do operationally better in the coming years.

SCIL is trading at 50 times FY-22E EPS as of now which can improve exponentially in the future.

| (INR Crore) | FY18 | FY20 | FY22E | FY24E | FY26E |

|---|---|---|---|---|---|

| Revenue | 1911 | 2423 | 3204 | 4237 | 5604 |

| EBITDA | 217.1 | 333.2 | 512.3 | 787.7 | 1211.2 |

| EBITDA % | 11.3 | 13.7 | 15.97% | 18.6% | 21.6% |

| PAT | 145 | 206 | 291 | 413 | 585 |

| EPS (INR) | 2.9 | 4.1 | 5.8 | 8.2 | 11.7 |

Balance Sheet & Cash Flows

| (INR Crore) | FY17 | FY18 | FY19 | FY20 | H1-FY21 |

|---|---|---|---|---|---|

| Reserves | 360 | 665 | 536 | 710 | 916 |

| Debt | 0 | 10 | 20 | 36 | 38 |

| Cash & Cash Equivalents | 38 | 66 | 40 | 83 | 466 |

| Investments | 277 | 2 | 1 | 87 | 203 |

| Gross Block | 107 | 306 | 345 | 425 | 448 |

| Operating Cash Flows | (21) | 49 | 75 | 222 | 539.1 |